All Categories

Featured

Table of Contents

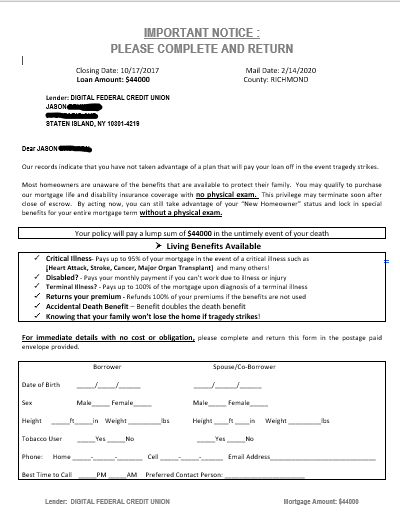

Life insurance policy representatives offer home loan defense and lending institutions offer home mortgage security insurance, sometime. Below are both kinds of agents that market home mortgage security (do you need life insurance for a mortgage). Restricted representatives help a firm and can just provide the business they are utilized by. That suggests if you consult with a captive agent, you will not have the possibility to shop numerous home mortgage defense firms.

Obtaining home loan defense through your loan provider is not constantly a very easy job, and most of the times fairly complicated. It is possible. Lenders normally do not offer mortgage defense that profits you. mortgage protection plan. This is where things obtain confusing. Lenders market PMI insurance coverage which is developed to protect the loan provider and not you or your family members.

Insurance For Mortgage Protection

The letters you get seem coming from your lending institution, but they are just coming from 3rd party business. mortgage job insurance. If you don't wind up obtaining traditional mortgage protection insurance, there are other sorts of insurance coverage you may been needed to have or could wish to think about to safeguard your financial investment: If you have a home financing, it will certainly be required

Especially, you will certainly desire dwelling coverage, components coverage and personal obligation. mortgage life and disability coverage. On top of that, you ought to take into consideration adding optional insurance coverage such as flood insurance policy, quake insurance policy, substitute price plus, water backup of drain, and various other frameworks insurance for this such as a gazebo, dropped or unattached garage. Equally as it seems, fire insurance coverage is a kind of residential or commercial property insurance policy that covers damage and losses created by fire

This is the main option to MPI insurance policy. Entire life is a permanent plan that is extra expensive than term insurance but lasts throughout your whole life.

Insurance coverage is generally restricted to $25,000 or much less, yet it does safeguard versus needing to touch various other financial resources when an individual passes away (insurance to pay off mortgage if you die). Final cost life insurance policy can be made use of to cover clinical expenses and various other end-of-life expenditures, consisting of funeral service and burial costs. It is a kind of irreversible life insurance coverage that does not run out, however it is a more pricey that term life insurance coverage

Va Mortgage Insurance Coverage

Some funeral homes will certainly accept the task of a final cost life insurance coverage plan and some will not. Some funeral chapels need settlement up front and will not wait till the last cost life insurance coverage plan pays. It is best to take this right into factor to consider when dealing when taking into consideration a last cost in.

Benefit repayments are not assessable for income tax functions. You have a number of options when it pertains to acquiring home loan protection insurance (mortgage insurance to pay off mortgage). Numerous business are extremely ranked by A.M. Best, and will certainly give you the included confidence that you are making the ideal decision when you acquire a policy. Among these, from our point of view and experience, we have actually located the following firms to be "the ideal of the very best" when it concerns issuing mortgage protection insurance coverage, and recommend any one of them if they are options presented to you by your insurance policy representative or home loan loan provider.

Cheap Insurance Mortgage Protection

Can you get home mortgage defense insurance policy for homes over $500,000? The largest difference in between home mortgage protection insurance policy for homes over $500,000 and homes under $500,000 is the demand of a medical exam.

Every business is different, but that is a good policy of thumb. With that said stated, there are a couple of companies that provide mortgage security insurance policy approximately $1 million without any medical examinations. home mortgage life insurance protection. If you're home deserves less than $500,000, it's very likely you'll receive plan that does not require medical examinations

Home mortgage security for reduced revenue housing generally isn't required as a lot of reduced income real estate systems are rented out and not possessed by the resident. Nonetheless, the owner of the systems can absolutely purchase home mortgage protection for low income real estate system tenants if the policy is structured appropriately. In order to do so, the homeowner would require to function with an independent agent than can structure a group strategy which enables them to combine the residents on one policy.

If you have questions, we extremely recommend talking with Drew Gurley from Redbird Advisors. Drew Gurley belongs to the Forbes Money Council and has actually worked some of one of the most one-of-a-kind and varied home loan protection plans - home insurance and mortgage protection. He can absolutely aid you believe via what is required to put this kind of strategy together

Takes the uncertainty out of safeguarding your home if you pass away or end up being impaired. Money goes straight to the mortgage business when a benefit is paid out.

Latest Posts

Funeral Expenses Benefit

Final Expense Life Insurance South Carolina

Funeral Service Insurance